- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

For enterprises engaged in foreign trade exports, applying for export tax rebates (exemptions) is a complex and crucial process that requires a series of preparatory steps. Below are some key preparatory steps:

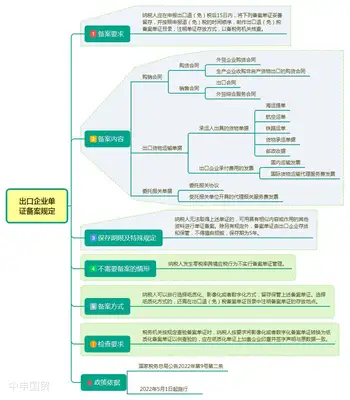

1、完成出口退(免)税备案:外贸企业需要首先完成出口退(免)税备案,可以通过电子税务局或使用专门的离线出口退税申报软件进行申请。

Complete tax rebate selection: Value-added tax (VAT) special invoices intended for export tax rebates must undergo tax rebate selection, and the invoice verification data must be synchronized to the declaration system.

Confirm revenue: If export goods meet the conditions for revenue recognition, they should be confirmed promptly. This is because enterprises must confirm sales revenue when applying for export tax rebates.

4、准备收汇材料:三类出口企业(新设立的出口退免税备案企业通常被归为此类),在次年4月份增值税纳税申报期后申报前一年度报关单时,需要提交收汇材料。即,如果申报出口退税已逾期,需要在收汇后才能进行申报。

5、匹配报关单和发票:根据出口商品的购销关系,将半岛电竞官网入口在哪里 出口报关单和购进的增值税专用发票逐一匹配。增值税专用发票上的商品名称应与半岛电竞官网入口在哪里 出口报关单的相符,增值税专用发票上的单位应与半岛电竞官网入口在哪里 出口报关单的至少一个计量单位相符。

Choose an export tax rebate declaration system: There are typically three methods for declaring export tax rebates: using offline declaration software, declaring online via the electronic tax bureau, or using the single-window export tax rebate module. For convenience, online declaration via the electronic tax bureau is recommended.

Manage export goods record-keeping documents: Within 15 days of declaring export tax rebates (exemptions), relevant documents such as purchase and sales contracts, export goods transport documents, and entrusted customs declaration documents must be filed in the Export Goods Record-Keeping Document Directory in the order of export goods, with the document storage location noted. In practice, it is advisable to collect and file these materials before declaring export tax rebates.

The above are some key preparatory steps for foreign trade enterprises applying for export tax rebates (exemptions). After completing these steps, enterprises can begin applying for export tax rebates.

Related Recommendations

© 2025. All Rights Reserved.沪ICP备2023007705号-2 PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912