- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

On May 17, 2023, local time Wednesday, the European Commission officially released the proposal titled EU Customs Reform: A Data-Driven Vision for a Simpler, Smarter, and Safer Customs Union, marking the most comprehensive reform of the EU Customs Union since its establishment in 1968.

The EU stated that this reform aims to address the current pressures on EU customs operations, including the significant growth in trade volumes (especially e-commerce), the rapid increase in EU-standard border checks, and the evolving geopolitical realities and crises.

As a key focus of the reform, the EU will establish a Customs Authority responsible for overseeing the EU Customs Data Hub, which will become the core of the new system. Over time, this new data hub is expected to replace the existing customs IT infrastructure of member states, saving an estimated €2 billion annually. The establishment of this new agency will also help improve the EUs risk management and inspection methods.

The unified EU Customs Data Hub mentioned in the EUs priorities is central to this reform. According to the EU, businesses importing goods into the EU will only need to enter product and supply chain information into this platform online. Based on the data provided by businesses, combined with machine learning, AI, and human intervention, regulatory authorities will gain a comprehensive overview of supply chains and goods flows.

For businesses, this will allow them to interact with a single platform and submit information for multiple shipments just once. With full transparency in supply chains and business processes, trusted traders can import goods into the EU without active customs intervention.

According to the EUs timeline, the EU Customs Data Hub will go live by 2028, by which time import declarations for e-commerce goods will be processed through this platform. After 2032, other traders can voluntarily start using the platform. The EU plans to conduct a review in 2035 to assess the feasibility of mandatory platform usage starting in 2038.

Of course, the EUs intention to make e-commerce the first to adopt the new system is related to this legislation.

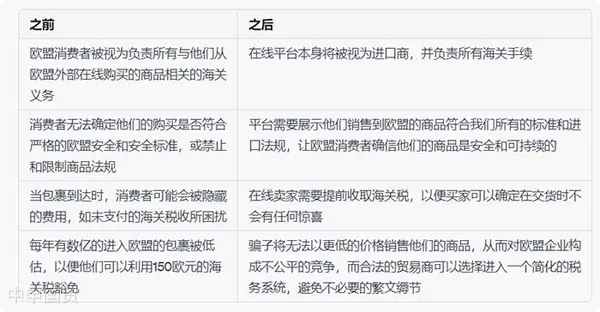

The EU stated that under the current customs system, consumers and carriers bear the primary responsibility for tariffs, but post-reform, this responsibility will shift mainly to e-commerce platforms. Platforms will be responsible for ensuring tariffs and VAT are paid at the time of purchase, rather than consumers paying additional fees or submitting documents upon receiving packages.

Most importantly, the EU also plans to abolish the current duty-free policy for imports valued below €150. The EU noted that approximately 65% of packages entering the EU intentionally undervalue goods to benefit from this policy. The EU estimates that this new system tailored for e-commerce will generate an additional €1 billion in customs revenue annually.

Meanwhile, with the digitization of tax declaration processes, tariff calculations for low-value goods will be simplified from thousands of possible tariff categories to just four, making it easier to calculate duties for small packages. This will also help e-commerce platforms and customs better manage the 1 billion e-commerce transactions imported into the EU annually.

According to the legislative process, the proposal will be submitted to the European Parliament and the Council of the EU for further consultation.

Related Recommendations

© 2025. All Rights Reserved.沪ICP备2023007705号-2 PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912